Back to Tax system configuration

Purpose

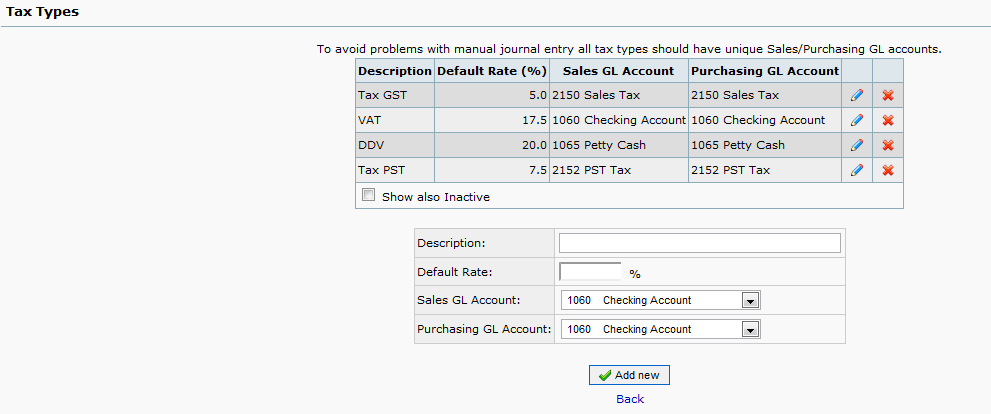

To assign GL accounts to each tax used by your business.

Procedure

Define all tax rates you will require. Depending on the location of your business you may need to set up federal, state/provincial, municipal/county, environmental, or other taxes. It is recommended that a separate sale and purchase GL account is assigned to each tax you require. Once this is complete, you should setup your Tax Groups and Item Tax Types

Screenshot

Tips and Tricks

Tax on Free Gifts

- Forum Post - Some countries like Columbia require VAT to be charged on free gifts, on either purchase price or normal sale price and the invoice needs to reflect this. The invoice should show:-

Item (free gift) $ 0.00 VAT @ 20% $ 2.00 Total $ 2.00

- Create a service item with same name as free gift, but excluding tax is one solution.

- Create a generic service item called Discount. Use

eachasUOM. Create anItem Tax TypewithTotal Tax Exemptand put this on the item. Then you can enter a Discount item with negative amount per item. You will also need to Allow Negative Prices in System and General GL Setup.

Import Tax

- Forum Post - Import Tax Standard Operating Procedure in FA

- If you need the possibility to enter Purchase Invoices from another country with Import Tax (so called zero'ed tax), you can do that the following way:

- Create a new account near the Sales Tax, e.g. 2151 and name it Import Tax and place it in Current Liabilities.

- Create a new Tax Type. Call it Import Tax. Give it the same rate as you use for normal tax, e.g. 23%. Select the newly created account for both sales and purchases.

- Don't include this Import Tax in any Tax Group.

- Create a Quick Entry. Call it Import. Select Supplier Invoice/Credit as type. Enter 'Invoice amount' as base amount description.

- Create a line, choose '% amount of base', select the newly created account, 2151 and enter -23 % (The same rate as the Import Tax Type with a minus sign).

- Create another line, choose '% amount of base', select the normal account for Purchase tax (maybe the same as Sales tax) and enter 23 % (the same rate as your normal Tax Type).

- In this way, you get sufficient statistics regarding Import Amounts on the Tax Report. Most tax authorities require this info.